When headlines scream “massive layoffs at UPS” and Amazon quietly builds its own shipping empire, something big is brewing in the logistics world. The recent UPS layoffs and Amazon’s aggressive in-house logistics expansion are more than news—they’re signs of a shifting balance of power.

In this post, we dive into what’s really happening, why it matters, and how it could shape the future of deliveries for everyone—from e-commerce giants to everyday consumers.

The Layoffs at UPS: What We Know So Far

In early 2024, UPS announced it would cut 12,000 jobs, largely affecting back-office and middle-management roles. The layoffs are part of a broader restructuring strategy to cut costs amid declining parcel volumes and increasing automation.

“We are rightsizing our organization to better align with current demand,” said UPS CEO Carol Tomé in a Q4 earnings call. CNBC reported that this move could save the company over $1 billion annually.

Why the Cuts?

- A 7.8% drop in U.S. domestic revenue

- Rising labor costs following the new Teamsters contract

- Increased competition from Amazon, FedEx, and regional carriers

The Bigger Picture: Revenue Pressures

UPS has been dealing with a post-pandemic slowdown. E-commerce growth has stabilized, leading to fewer home deliveries. Meanwhile, Amazon—once a major customer—is now a full-blown competitor. Together, these forces are reshaping UPS’s business model.

Amazon’s Logistics Empire: From Customer to Competitor

Once heavily reliant on carriers like UPS and FedEx, Amazon now delivers over 70% of its own packages in the U.S. According to The Wall Street Journal, Amazon Logistics has surpassed FedEx in parcel volume and is second only to UPS.

Amazon’s model is clear:

- Build internal capacity through regional hubs, last-mile delivery stations, and an airline fleet (Amazon Air)

- Use third-party delivery partners (DSPs) to handle local routes

- Leverage AI and automation to optimize routes and warehouse operations

By investing in infrastructure, Amazon is no longer dependent on UPS during peak seasons. Instead, it competes directly.

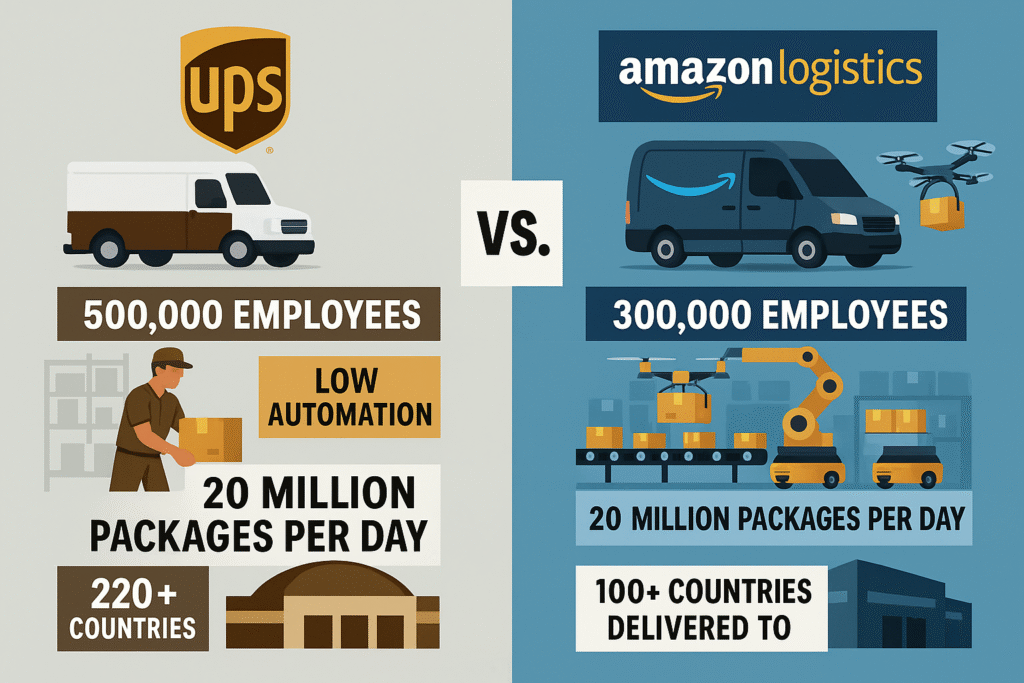

UPS vs Amazon: A Quick Comparison

| Feature | UPS | Amazon Logistics |

|---|---|---|

| Founded | 1907 | 2015 (logistics division) |

| Peak Workforce | ~500,000 | ~275,000 (logistics-related roles) |

| Delivery Coverage | Global | Primarily U.S. with growing international reach |

| Automation Use | Moderate | High (robotics, AI routing) |

| Package Volume (U.S.) | ~5.2B (2023) | ~4.8B (2023) |

| Profit Focus | Shipping revenue | E-commerce support & customer retention |

Key Insight: Amazon’s logistics isn’t a standalone business—it’s an enabler of its broader e-commerce and Prime ecosystem.

What This Means for the Industry

The UPS layoffs and Amazon’s logistics dominance are not isolated stories. They reflect three major trends reshaping the delivery landscape:

1. Consolidation of Power

Amazon is vertically integrating to control everything from warehouses to doorsteps. UPS, meanwhile, is streamlining to maintain competitiveness.

2. Rise of Automation

Both companies are betting big on automation. Amazon, however, appears ahead—thanks to its tech-driven culture and vast data resources.

3. New Delivery Norms

Customer expectations are higher than ever. Two-day and same-day deliveries are now standard. Amazon sets the pace, and others must follow or fall behind.

A Personal Reflection: The Human Cost

While the business story is compelling, there’s also a personal toll. A former UPS middle manager I spoke with shared how sudden the layoff felt:

“It wasn’t just about losing a paycheck. It was losing a sense of purpose. We were loyal, but the market shifted faster than we could adapt.”

Stories like these remind us that transformation comes with emotional costs. Thousands of workers are navigating uncertain futures.

The Broader Tech Angle: Google’s Role

So where does Google stock fit in? While not directly tied to UPS or Amazon logistics, Alphabet (Google’s parent company) is a quiet enabler behind the scenes:

- Google Cloud provides AI, analytics, and logistics tech

- Waymo (Alphabet’s autonomous vehicle arm) hints at future driverless delivery

- Alphabet’s stock growth shows strong investor confidence in AI, automation, and logistics enablement

Logistics isn’t just about trucks anymore. It’s about code, algorithms, and cloud infrastructure—and Google is right there in the mix.

Conclusion: What Lies Ahead

The story of UPS layoffs and Amazon building a logistics behemoth isn’t just corporate strategy—it’s the dawn of a new delivery era: faster, smarter, and more automated.

For consumers, the transformation could lead to faster deliveries and smarter tracking systems. For workers, it highlights the growing need to reskill and stay relevant in an increasingly automated world. And for competitors, the message is clear: innovate rapidly—or risk fading into irrelevance.